|

|

|

|

|

|

|

|

Main page > Conferences > Prospects for Development of LNG in Russia

Prospects for Development of LNG in Russia

Key topics of Konstantin Simonov's speech at LNG 2008. The Future for LNG: Where is the Industry Going.

London, April 23, 2008.

- ↓ Difficulties of Developing LNG Projects in Russia

- ↓ LNG as a new opportunity for Russia

- ↓ Aims of Gazprom

- ↓ First Steps

- ↓ LNG in Gazprom Strategy

- ↓ Lawmaking in the LNG Segment

- ↓ Shelf Sovereignty

- ↓ Shelf will be the Property of Gazprom and Rosneft

- ↓ But State Companies will need foreign Partners

- ↓ Sakhalin-2

- ↓ Baltic LNG

- ↓ Shtokman

- ↓ Shtokman as the new model of cooperation with foreign companies in shelf projects

- ↓ Yamal Shelf

- ↓ Conclusion

(Read this speech's presentation in PDF  152 KB)

152 KB)

Difficulties of Developing LNG Projects in Russia

- LNG and export of gas by tankers is very unusual for Russia

- Two «habits»: «land and pipes»

- So LNG is like psychologic revolution for Russian gas industry

- The idea to consider LNG exports seriously was born inside Gazprom only after the second trip of the new company’s head Aleksey Miller to the World Gas Congress in Tokyo in 2003, where competitiveness and attractiveness of LNG market was one of the main subjects.

- Almost immediately after Miller’s return, a meeting was held in Gazprom, at which the first order to develop an LNG strategy was given. It was decided to organize a committee that would prepare LNG project.

LNG as a new opportunity for Russia

Development of LNG production and export will allow:

- fulfill gas reserves potential with a maximum economic effect, including supplies to distant consuming markets

- gain foothold in new regions (North America, Spain, Pacific Rim, in a more distant future – South America and India)

- turn into a center of world rather than regional energy supply and guarantor of world energy security

Aims of Gazprom

Strategic goals of Gazprom in the LNG production and supplies sphere are:

- organize an effective LNG production and

- supplies system using up-to-date technologies diversify supplies and work with a larger number of consumers

- establish itself as a leader in the LNG market

First Steps

Gazprom executives claim that the company has been implementing a phased strategy aimed at boosting Gazpom’s share of the LNG market since 2004, counting from the start of speculative (and later spot) operations with outsourced liquefied gas by Gazprom’s lower-tier subsidiary Gazprom Marketing & Trading

For the four years Gazprom made one off transactions and swap operations (LNG – pipeline gas) with BP and Gaz de France and supplied LNG to the USA, Great Britain, South Korea and Japan. In all, Gazprom sold around 1 bcm of LNG

The goal of these projects that were on the edge of profitability was to gain experience of real trade in this unique market and run the full chain (apart from LNG production) from transportation to regasification.

| Date | Source | Volume | Terminal | Customer |

|---|---|---|---|---|

| September 2005 | British Gas Group | Around 80 million m³ of natural gas | Cove Point (US) | Shell Western BV |

| December 2005 | Gaz de France (Egypt) | Around 80 million m³ of natural gas | Cove Point (US) | Shell Western LNG |

| April 2006 | Gaz de France | Around 85 million m³ of natural gas | Isle of Grain (UK) | BP |

| August 2006 | Mitsubishi Corporation (Oman) | Around 92 million m³ of natural gas | Chita | Chubu Electric Power |

| August 2006 | Mitsubishi Corporation (Oman) | Around 92 million m³ of natural gas | Tokyo Electric Power Company | |

| September 2006* | BP (Trinidad & Tobago) | Around 80 million m³ of natural gas | Cove Point (US) | |

| October 2006 | Mitsubishi Corporation (Oman) | Around 92 million m³ of natural gas | Pyeongtaek | Kogas |

* A medium-term contract was signed with BP for 2006-2007, including sale of rights for several tanker shipments from Trinidad & Tobago to the USA.

Source: Gazprom

LNG in Gazprom Strategy

Gazprom believes that Russian LNG will open the following opportunities:

- participation and commercial use of remote gas reserves

- opportunity to reduce export risks by combining pipeline technologies and LNG

- increase flexibility of gas exports

- positioning of Gazprom in the new high-yielding markets,

- such as the USA, Japan and Spain that are inaccessible for the Russian grid gas

- positioning of Gazprom in all elements of the LNG price chain, including carrier shipping and regasification

- increase of LNG demand that in the past 10 years has been increasing 2.5% per year on average

Lawmaking in the LNG Segment

Economic Development and Trade Ministry and Gazprom proposed and the government passed lifting of LNG export customs duty.

While pipeline exports are subject to 30% tax of the gas price for the customer, lifting of customs duty for LNG makes LNG projects very attractive and reduces financial burden on their owners (which looks like a great deal considering high capital intensiveness of LNG projects).

The second decision resulted in a Gas Export Federal Law enacted in summer 2006. The law says that the owner of the unified gas transmission system (Gazprom, that is) has the monopoly on exports of natural gas, including in liquefied state. Only projects regulated by PSAs do not fall under the law (only Sakhalin-2 in the LNG case).

LNG export projects not affiliated with Gazprom were officially banned, whereas 2-3 years prior to that such projects were actively discussed(for example, LNG plant based on South-Tambei deposit).

Shelf Sovereignty

In new version of Subsoil Law there is the new term: «federal field».

Federal is the field with mineable resource:

- Gas – 50 bcm

- Oil – 70 mln tons

All shelf fields also have federal status.

Shelf will be the Property of Gazprom and Rosneft

If you want to be the nominee of shelf fields you must satisfy the following requirements:

- to have an experience of work on Russian shelf more than 5 years

- to have the Share of Russian Federation not less than 50%+1

But State Companies will need foreign Partners

- Sharing of investment risk: Rosneft said that investment to shelf project will be $2,44 trillion until 2050 – it’s two times higher than Russian GDP in 2007. Now the share of o&g production on shelf in Russia is 2.7% -it can be 10% in 2020

- Technologies

- Markets

Sakhalin-2

The project’s design was to produce around 15 bcm of gas per year at the Lunskoye deposit, lay down gas pipeline across the island, from the north to the south, and build a LNG plant (with a capacity of 9.6 million tons a year) and a LNG export terminal.

By the time Gazprom was brought in, 98% (9.4 million tons) of gas was contracted under long-term agreements (15+ years) with the consumers in the USA, Japan (two thirds of all gas contracted) and South Korea.

After Gazprom’s arrival new possibilities may open before the project – another LNG plant with the capacity of 4.8 million tons. S2facilities may be expanded in order to receive gas from the Sakhalin-1 project (6-7 bcm a year that are currently non-demanded in the domestic market and may become resource base for the second plant).

Baltic LNG

In February 2008 Gazprom executive board that had previously put off a decision on the project that was named Baltic LNG announced that it was found economically inadvisable.

But it doesn’t mean the decline of Gazprom’s interest to LNG business – Baltic project from the very outset was problematic -e.g. the was no reliable recourse base.

Shtokman

Shtokman project has the following advantages:

- large reserves of gas, which will secure stable long-term LNG production

- possibility to expand production depending on the market climate

- expansion of LNG production increases economic effectiveness

- favorable gas composition

- favorable geographical location in relation to existing and proposed receiving terminals in consumer markets(Canada, Mexico, eastern coast of the United States);

- possibility to diverse supplies – simultaneous supplies to Europe and the USA, varying destinations depending on market conditions

- absence of ice and permafrost

Shtokman as the new model of cooperation with foreign companies in shelf projects

In 2006 Gazprom told that there will be no partners in Shtokman.

But in 2007 the blocking stake of the Shtokman’s first phase was won by Total, 24% more went to Norway’s StatoilHydro.

Project’s owners are expected to approve investment program by mid2009.

The question whether foreign owners will get Shtokman reserves on their balance (in proportion to their stakes) remains uncertain. After the announcement of the transition of 25% to Total, the French side said it planned to put the reserves on its balance sheet. However, the managers of the Norwegian company questioned such possibility in public.

Taking into account annual output and 25 years life of the project, the share of Gazprom’s partners is 140 bcm of gas for each partner. But they will not have a right to export this gas. The partnership company that Gazprom, Total and StatoilHydro will establish will be selling the entire gas (both meant for pipelines and LNG) to Gazprom under a special formula that will depend on export climate. Gazprom Export will be in charge of marketing policy.

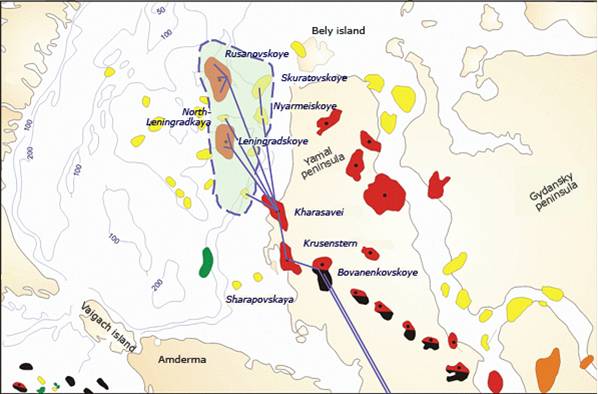

Yamal Shelf

Source: VNIIGAZ

Conclusion

Russia has vast gas reserves on the continental shelf, which is logical to use to develop LNG projects.

Massive development of the oil and gas potential of the Russian northern seas is distant because of the lack of own technologies.

Governmental regulation of access to subsoil made it impossible for private companies to organize partnerships and develop independent LNG projects. Gazprom’s monopoly on LNG exports and plans to give the company offshore licenses without tenders mean that the state company will be dominating in every promising LNG project.

Even by 2015-2020 probability of successful launch of such projects depends on Gazprom’s partnership with foreign partners. Basic pattern of partnership will probably be the model used over Shtokman. However, its effectiveness is yet to be confirmed in the course of feasibility study and consultations of foreign participants in the project with the US SEC on the possibility to put first phase reserves on the balance sheets of Total and StatoilHydro in proportion to their stakes in the operator company (that does not formally own any reserves).

The main target market for new Russian LNG (except for the already divided Sakhalin’s gas) is the rapidly developing North American market. Supplies to remote parts of Europe do not seem economically sound in the current conditions. But in the future this may change if LNG pricing principles change or price arbitrage is used (exchange of supply rights with producers in the Middle East)

Thank you!

Special report:

Nord Stream 2 and Ukraine: Costs Should Decide

Shale Revolution: Myths and Realities

Liquefied Natural Gas Outlook: Expectations and Reality

Analytical series “The Fuel and Energy Complex of Russia”:

Oil and Gas Sector Regulation and Interim Results in 2024. Outlook for 2025

Northern Logistics Route: Should One Expect a Breakthrough?

Current Status of Russian Oil Exports

Green and Climate Agenda: Reset Attempt

Government 2024: New Configuration of Regulators

Lithium: New Energy Eldorado?

West’s Latest Sanctions Decisions, Their Effect on Russian Oil and Gas Industry

State regulation of the oil and gas sector in 2023, 2024 outlook

All reports for: 2015 , 14 , 13 , 12 , 11 , 10 , 09 , 08 , 07

National Energy Security Fund © 2007

There has been much discussion about how Russia – Europe’s biggest gas supplier – can continue to supply gas to Europe over the coming decades in the most secure and cost efficient way. Gazprom and its European partners have decided that building two additional pipelines through the Baltic Sea (Nord Stream 2) is the best commercial solution to secure future gas supplies for the EU, where gas production continues to decline and demand is expected to grow.

There has been much discussion about how Russia – Europe’s biggest gas supplier – can continue to supply gas to Europe over the coming decades in the most secure and cost efficient way. Gazprom and its European partners have decided that building two additional pipelines through the Baltic Sea (Nord Stream 2) is the best commercial solution to secure future gas supplies for the EU, where gas production continues to decline and demand is expected to grow. The boom in shale gas production in the US and its wide-ranging influence on markets rocked the gas world. Liquefied gas deliveries were redirected, altering the already fragile balance of demand and supply in traditional markets for pipeline gas in Europe.

The boom in shale gas production in the US and its wide-ranging influence on markets rocked the gas world. Liquefied gas deliveries were redirected, altering the already fragile balance of demand and supply in traditional markets for pipeline gas in Europe. World market has shown interest to liquefied gas. Russia has so far been aside of it. However, producers have announced several large LNG projects. The new study will help investigate this delicate subject and understand what is in store for LNG production and export in the nearest years.

World market has shown interest to liquefied gas. Russia has so far been aside of it. However, producers have announced several large LNG projects. The new study will help investigate this delicate subject and understand what is in store for LNG production and export in the nearest years. A new government was formed in Russia in spring 2024. Sergey Tsivilyov became Energy Minister. The first six months of the new government’s regulation of the fuel and energy sector are already past, which enables drawing the first analytical conclusions. Therefore, interim production results for 2024 have a special place in this research. We analyse the past year in two papers at once, as has become a tradition already. The gas industry is considered in a separate report. Meanwhile, we focus on oil here. The report’s special value lies in the data of our own oil export estimation model.

A new government was formed in Russia in spring 2024. Sergey Tsivilyov became Energy Minister. The first six months of the new government’s regulation of the fuel and energy sector are already past, which enables drawing the first analytical conclusions. Therefore, interim production results for 2024 have a special place in this research. We analyse the past year in two papers at once, as has become a tradition already. The gas industry is considered in a separate report. Meanwhile, we focus on oil here. The report’s special value lies in the data of our own oil export estimation model. The Northern Sea Route and the Arctic in general were made a state priority even before the conflict in Ukraine. The key question is: can nice talk about the NSR as a profitable and strategic route and about Russia’s return to the Arctic be converted into actual breakthroughs making it possible to carry out at least the executive’s own plans? The strategic content concerning the NSR is relatively new, but many problems are old.

The Northern Sea Route and the Arctic in general were made a state priority even before the conflict in Ukraine. The key question is: can nice talk about the NSR as a profitable and strategic route and about Russia’s return to the Arctic be converted into actual breakthroughs making it possible to carry out at least the executive’s own plans? The strategic content concerning the NSR is relatively new, but many problems are old. Getting over the 2022-2024 sanctions is the most important test for the Russian oil industry. After the US, United Kingdom, EU, and G7 introduced a ban on buying Russian oil and petroleum products (with some exceptions) and the price cap mechanism, Russia managed to find alternative sale options in countries that are now commonly called the “Global South”. However, it is important to consider exports in detail. This is what we do in the new NESF report.

Getting over the 2022-2024 sanctions is the most important test for the Russian oil industry. After the US, United Kingdom, EU, and G7 introduced a ban on buying Russian oil and petroleum products (with some exceptions) and the price cap mechanism, Russia managed to find alternative sale options in countries that are now commonly called the “Global South”. However, it is important to consider exports in detail. This is what we do in the new NESF report. In spite of dramatic worsening of relations with the West, the subject of climate has not vanished from Russian economic plans. Environmental issues have even topped the list of declared problems.

In spite of dramatic worsening of relations with the West, the subject of climate has not vanished from Russian economic plans. Environmental issues have even topped the list of declared problems. While the result of the presidential election in Russia was absolutely predictable, further moves forming new government agencies were more intriguing. Eventually, on the one hand, it would seem that Putin chose to avoid radical decisions on the civilian part of the Cabinet. Prime Minister Mishustin kept his post and almost all deputy prime ministers did. On the other, there are still meaningful changes. First of all, the Ministry of Energy got a new head. This alone deserves special attention.

While the result of the presidential election in Russia was absolutely predictable, further moves forming new government agencies were more intriguing. Eventually, on the one hand, it would seem that Putin chose to avoid radical decisions on the civilian part of the Cabinet. Prime Minister Mishustin kept his post and almost all deputy prime ministers did. On the other, there are still meaningful changes. First of all, the Ministry of Energy got a new head. This alone deserves special attention. The energy transition is, on the one hand, rightly perceived by Russian oil and gas companies as a threat to their business. On the other, one should also look for new opportunities in the new energy industry. One of them is the production of lithium, the most important resource for electric vehicle batteries. The industry is rapidly growing, which opens up new horizons, for conventional fuel and energy companies, among others. Lithium is already beginning to cause increased interest in Russia, which calls for close scrutiny of the topic.

The energy transition is, on the one hand, rightly perceived by Russian oil and gas companies as a threat to their business. On the other, one should also look for new opportunities in the new energy industry. One of them is the production of lithium, the most important resource for electric vehicle batteries. The industry is rapidly growing, which opens up new horizons, for conventional fuel and energy companies, among others. Lithium is already beginning to cause increased interest in Russia, which calls for close scrutiny of the topic. The report presents an analysis of the latest sanctions decisions on the part of the US, EU, and United Kingdom as well as practical measures to implement them.

The report presents an analysis of the latest sanctions decisions on the part of the US, EU, and United Kingdom as well as practical measures to implement them. The year 2023 posed a serious challenge to the Russian oil and gas sector that was subjected to extremely tough sanctions that could have led to collapse in exports of crude oil and petroleum products. The oil industry and corresponding regulatory mechanisms were tested throughout the year. The state, being in dire need of financial resources, had to save the chicken that lays golden eggs. How well is it coping with this task?

The year 2023 posed a serious challenge to the Russian oil and gas sector that was subjected to extremely tough sanctions that could have led to collapse in exports of crude oil and petroleum products. The oil industry and corresponding regulatory mechanisms were tested throughout the year. The state, being in dire need of financial resources, had to save the chicken that lays golden eggs. How well is it coping with this task?